I'm not sure why I started collecting these quotes. I liked Justice Breyer's Saint Peter story, and it just grew from there. Sir Thomas More was a lawyer, but saw Utopia as having no lawyers. The United States had 281 lawyers per 100,000 people in 1991, while Japan had 11. I don't have any specific grievances against lawyers. Sorry, Ben and George.

"Woe unto you also, ye lawyers!

for ye lade men with burdens grievous to be borne,

and ye yourselves touch not the burdens

with one of your fingers."

— Luke 11:46

"The first thing we do,

let's kill all the lawyers."

— William Shakespeare, Henry VI Part II, Act IV, Scene II

"God works wonders now and then:

Behold! A lawyer and an honest man!"

— Benjamin Franklin

"The lawyers’ truth is not Truth,

but consistency or a consistent expediency.

— Henry David Thoreau, "Civil Disobedience"

Saturday, December 30, 2017

Thursday, December 28, 2017

How Did Bob Corker Go from ‘Dead Broke’ to $69 Million during 11 Years in the U.S. Senate?

The Tennessee Star, December 23, 2017

“How do you increase your net worth by 69 million dollars while you’re working full-time as a Senator?” That’s the question Rolling Stone reporter Matt Taibbi asked about Senator Bob Corker (R-TN) on Friday.

Neither Taibbi nor Rolling Stone are fans of Corker (or of President Trump, Republicans, or conservatism in general). And Rolling Stone has had problems of its own, recently, as has Taibbi.

Nonetheless, Taibbi puts a fine point on what many political watchers across the Volunteer State have been asking for years.

Tuesday, December 26, 2017

Bill O'Donnell

Coyle High School graduation, Taunton, MA, 1943 and PFC O'Donnell

William J. O'Donnell was born in Taunton, Massachusetts on March 18, 1925. He attended Coyle High School, where he covered school sports for the Taunton Gazette. After graduating in 1943 Bill enlisted in the U.S. Army as a trainee in the Army Specialized Training Program at Brooklyn College.3

The trainees were under military discipline, wore regulation uniforms, stood formations such as reveille, and marched to classes and meals. The standard work week was 59 hours of "supervised activity," including a minimum of 24 hours classroom and lab work, 24 hours required study, 5 hours military instruction, and 6 hours physical instruction. The Colonel who ran the program told a Congressional committee that ASTP studies were more rigorous than those at West Point or the Naval Academy.4

Monday, December 25, 2017

Corporate Personhood

Corporate personhood is the legal notion that a corporation, separate from its associated owners, managers, or employees, has legal rights and responsibilities enjoyed by natural persons. This is an ongoing legal debate in the United States.

A chronology of U.S. court decisions that define corporate personhood (with an explanation of citations):

A chronology of U.S. court decisions that define corporate personhood (with an explanation of citations):

- Trustees of Dartmouth College v. Woodward – 17 U.S. 518 (1819) Beginning with this opinion the Supreme Court has continuously recognized corporations as having the same rights as natural persons to contract and to enforce contracts. "The opinion of the Court, after mature deliberation, is that this corporate charter is a contract, the obligation of which cannot be impaired without violating the Constitution of the United States. This opinion appears to us to be equally supported by reason, and by the former decisions of this Court."

- Society for Propagation of Gospel v. Town of Pawlet - 29 U.S. 480 (1830), in which an English corporation dedicated to missionary work sought to protect its rights to land in the U.S. under colonial grants against an effort by the state of Vermont to revoke the grants. Justice Joseph Story, writing for the Supreme Court, explicitly extended the same protections to corporate-owned property as it would have to property owned by natural persons. Seven years later, Chief Justice Marshall stated: "The great object of an incorporation is to bestow the character and properties of individuality on a collective and changing body of men."

- Santa Clara County v. Southern Pacific – 118 U.S. 394 (1886). Chief Justice Waite of the Supreme Court orally directed the lawyers that the Fourteenth Amendment equal protection clause guarantees constitutional protections to corporations in addition to natural persons, and the oral argument should focus on other issues in the case. "The court does not wish to hear argument on the question whether the provision in the Fourteenth Amendment to the Constitution, which forbids a State to deny to any person within its jurisdiction the equal protection of the laws, applies to these corporations. We are all of the opinion that it does."

Sunday, December 24, 2017

Snowplow to All!

Snow Plow Update: 12/24

noreply@cityofmadison.com

Sun 12/24/2017, 8:37 AM

...No creatures were stirring, except for Streets Division snow plow operators!

Thirty-three plow drivers sprang from their beds to fight the new-fallen snow. Crews are maintaining the city’s salt routes and sand first areas to assist everyone making their way through the city with their sleighs full of toys...

With weather like this, it’s best not to travel as quick as a flash. Slippery spots may develop throughout Madison, especially in residential areas...

As with all snowy days, we at the Streets Division exclaim, “make good choices” to all so we all can have a good night.

Saturday, December 23, 2017

Malefactors of Great Wealth

I regard this contest as one to determine who shall rule this free country — the people through their governmental agents or a few ruthless and domineering men, whose wealth makes them peculiarly formidable, because they hide behind the breastworks of corporate organization.

― Theodore Roosevelt, Address on the occasion of the laying of the corner stone of the Pilgrim memorial monument, August 20, 1907

Comeback Words for 2018

Doug Mills/The New York Times

Doug Mills/The New York TimesWhen Americans were asked in a recent survey for the first word that comes to mind when thinking of Trump, the most common reply was “idiot.”

The top ten were "idiot," "liar," "incompetent," "leader," "strong," "asshole," "great," "moron," "arrogant," and "disgusting." Three out of ten's not bad.

Timothy Egan, The New York Times, December 23, 2017

You can call a slimehead by the better-known name of orange roughy, but it’s still an ugly fish. The same goes for President Trump’s attempt to euphemize a first year in office that was historic for all the wrong reasons.

A regime that gave the world “alternative facts” has been working overtime at year’s end to banish words it doesn’t like or believe in, and to take credit for, or reframe, good things that it had very little to do with.

Friday, December 22, 2017

The Gift of the Magi

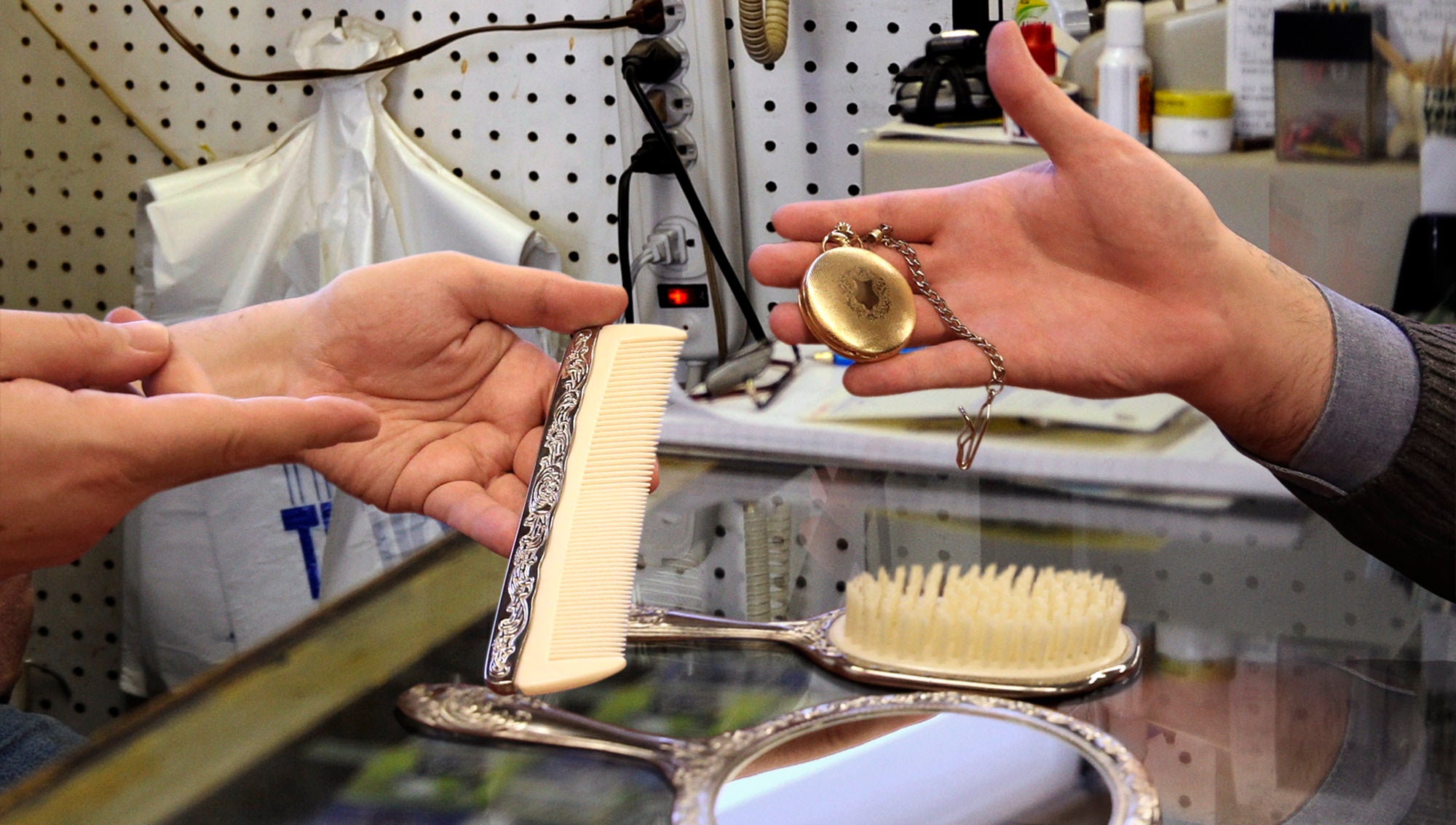

Report: More Americans Forced To Sell Gold Pocket Watch In Order To Afford Set Of Fine Combs For Wife

NEW YORK — Citing the limited household budgets of many young married couples, a new report published Friday estimates that more Americans than ever this Christmas will be forced to sell a gold watch inherited from their father in order to buy a set of fine combs for their wife’s beautiful hair.

“Wages have remained flat while the cost of living has increased, a combination that could leave holiday shoppers in a bind as they attempt to find a gift that befits a woman whose cascade of shining brown hair is the envy of queens,” said economist and report co-author Jay Dillingham, adding that retailers have given no indication they plan to offer any discounts this season on lavishly bejeweled combs of pure tortoiseshell.

“Especially in major cities, where workers are spending even more of their income on rent than in the past, we can expect to see a growing number of steadfast and honorable husbands pawning an heirloom pocket watch, one that has been in their family for generations, in order to purchase a rare and elegant gift worthy of their true love’s exquisite locks.”

The report went on to say that, in some cases, Americans may even have to hock their antique whalebone-and-silver walking sticks for the woman they cherish above all others.

— Vol 53 Issue 51, The Onion

The magi, as you know, were wise men — wonderfully wise men — who brought gifts to the Babe in the manger. They invented the art of giving Christmas presents. Being wise, their gifts were no doubt wise ones, possibly bearing the privilege of exchange in case of duplication. And here I have lamely related to you the uneventful chronicle of two foolish children in a flat who most unwisely sacrificed for each other the greatest treasures of their house. But in a last word to the wise of these days let it be said that of all who give gifts these two were the wisest. Of all who give and receive gifts, such as they are wisest. Everywhere they are wisest. They are the magi.

The Gift of the Magi, William Sydney Porter (O. Henry), The New York Sunday World, December 10, 1905

Will Isolationism Work in the 21st Century?

President Trump with his cabinet at the White House before the UN vote. (Doug Mills/The New York Times)

President Trump with his cabinet at the White House before the UN vote. (Doug Mills/The New York Times)Trump Threatens to Take His Ball and Go Home, but Can He?

The answer is yes, if he calls it unilateralism and not isolationism. The global economy does not want trade tariffs.

"In a collective act of defiance toward Washington, the United Nations General Assembly voted 128 to 9, with 35 abstentions and 21 absent, for a resolution demanding that the United States rescind its Dec. 6 declaration on Jerusalem, the contested holy city.

“We will remember it when we are called upon once again to make the world’s largest contribution to the United Nations,” [Nikki Haley] said of the vote. “And we will remember when so many countries come calling on us, as they so often do, to pay even more and to use our influence for their benefit.”

Thursday, December 21, 2017

Cardinal Bernard Law is Dead

Cardinal Bernard F. Law in Washington in 2002. The disgraced former archbishop of Boston died in Rome on Wednesday. (Ken Lambert, Associated Press)

Cardinal Bernard F. Law in Washington in 2002. The disgraced former archbishop of Boston died in Rome on Wednesday. (Ken Lambert, Associated Press)It wasn’t that he was a pedophile. He found himself having to manage a difficult situation. It’s not that he himself behaved badly. In my times, there was a different instruction. If something happened in a family, it was the role of the father of a family to hide it. Now it is all about the media and saying sorry. It was natural that he defended his children, the priests. We can’t criticize what happened then with the mentality of today. It’s not fair.

— Monsignor Gino Di Ciocco, Rome. "Cardinal Law and the U.S.-Rome Sex Abuse Divide," Jason Horowitz, The New York Times, December 20, 2017. Except the children weren't the priests.

Spotlight is a 2015 American film of the widespread and systemic child sex abuse in the Boston area by Roman Catholic priests. It is based on a series of stories that earned The Boston Globe the 2003 Pulitzer Prize for Public Service. Spotlight won the Academy Award for Best Picture and Best Original Screenplay.

— Spotlight (film), Wikipedia, retrieved September 10, 2019. Trailer.

My remarks, which some bishops found offensive, were deadly accurate. I make no apology. To resist grand jury subpoenas, to suppress the names of offending clerics, to deny, to obfuscate, to explain away; that is the model of a criminal organization, not my Church.

— Frank Keating, former governor of Oklahoma, prosecutor, and FBI agent, on resigning as chairman of the Catholic Church panel on sexual abuse. Keating had compared some bishops to "La Cosa Nostra." "Refusing to Recant, Keating Resigns as Church Panel Chief," Daniel J. Wakin, The New York Times, June 17, 2003, pg. A16.

Wednesday, December 20, 2017

GOP, a Gloating of Patricians

pa·tri·cian: noun 1. an aristocrat or nobleman

Yes, just your ordinary family that owns two businesses accounting for 40% of its income.

In reality, the vast majority of middle-class households have no business income, and for most of those who do have such income, it’s less than a quarter of their total income, let alone 40%. Meanwhile, the top 1% accounts for more than half of business income, and the top 5% for around 70% of the total. Since the value of the pass-through tax break depends on how high a marginal rate you pay on ordinary income, the benefits are even more skewed to the top

The point is that the modern GOP basically despises ordinary working families, and this is increasingly obvious to the public. Better salesmanship won’t solve this problem.

— "Republicans Despise the Working Class, Continued," Paul Krugman, The New York Times, December 20, 2017

A Difference of Opinion

There seems to be a difference of opinion on the GOP tax bill:

- "Tax Bill gives Americans cash Christmas present they really want," Alfredo Ortiz, Fox News, 12/19/17

- "The new tax plan is the worst Christmas present for the middle class," Richard V. Reeves, The Brookings Institution, December 19, 2017

Ortiz's picture (he evidently creates NASCAR jobs) came from the American Legislative Exchange Council (ALEC), those wonderful people who brought you model bills on the Kansas tax cuts, Stand Your Ground laws, voter identification, illegal immigration, animal and ecological terrorism, privatizing state prisons, three-strikes laws, support for Enron and deregulation of electric utilities in the 1990s, the Keystone XL pipeline, prohibition of public broadband services, privatizing public education, and repeal of the Affordable Care Act. ALEC has been busy, and well-funded by corporations, think tanks, and trade groups.

Rep. Mark Pocan on Fellow Badger Paul Ryan

Speaker Ryan and House Republicans just passed one of the biggest legislative scams in American history. Despite all of the rhetoric, lofty promises, and downright lies, the GOP tax bill is not written for the middle class, it’s written for corporations and the wealthy. Today, Speaker Ryan and Republicans confirmed loud and clear that their priority is to help corporate and special interests at the expense of working families in Wisconsin and across the United States.

Make no mistake, the Republican tax plan will negatively impact millions of American families, but what Speaker Ryan will do next is even worse. The handouts to corporations and the wealthy from this bill are so drastic that they are projected to balloon the deficit by more than $1.4 trillion, and Speaker Ryan is already planning to use this as an excuse to make massive cuts to programs like Medicare and Social Security.

And while Speaker Ryan has been fighting to give corporations tax cuts at the expense of the middle class, he’s neglected to reauthorize critical services like the Children’s Health Insurance Program and the Federal Perkins Loans Program. When Congress returns in January, I will do all that I can to fight for working families and stop Speaker Ryan’s radical agenda from doing more harm.

— Rep. Mark Pocan, Wisconsin 2nd District, Dec 19, 2017

Make no mistake, the Republican tax plan will negatively impact millions of American families, but what Speaker Ryan will do next is even worse. The handouts to corporations and the wealthy from this bill are so drastic that they are projected to balloon the deficit by more than $1.4 trillion, and Speaker Ryan is already planning to use this as an excuse to make massive cuts to programs like Medicare and Social Security.

And while Speaker Ryan has been fighting to give corporations tax cuts at the expense of the middle class, he’s neglected to reauthorize critical services like the Children’s Health Insurance Program and the Federal Perkins Loans Program. When Congress returns in January, I will do all that I can to fight for working families and stop Speaker Ryan’s radical agenda from doing more harm.

— Rep. Mark Pocan, Wisconsin 2nd District, Dec 19, 2017

Monday, December 18, 2017

Tax Cut for Corporations Paid by Individuals

CBO = Congressional Budget Office

TCJA = Republican Tax Cuts and Jobs Act

Details on the GOP Tax Plan

The final tax bill from the Republican House-Senate conference committee is out, and I have a comparison of some numbers below.

The current 2018 numbers come from "IRS Announces 2018 Tax Brackets, Standard Deduction Amounts, And More," Kelly Phillips Erb, Forbes, October 19, 2017. The GOP Tax Bill numbers are from "What's in the Final Republican Tax Bill," Wilson Andrews and Alicia Parlapiano, New York Times, December 17, 2017, p. 21 and "What’s in the Tax Bill, and How It Will Affect You," Ron Lieber and Tara Siegel Bernard, New York Times, updated December 17, 2017.

Selfishly, my typical example is a married couple filing a joint return with no dependents.

Again, selfishly, I am not overwhelmed by my temporary 12% total deduction/exemption increase or my 3% tax rate cut, both set to expire after seven years because the Republicans don't have 60 votes. Someone making $624,000 would have an overall tax cut of 11% from the rate reductions and bracket changes, almost four times mine. And then the corporate tax cut is 14% and permanent. This doesn't even look at the new loopholes for pass-through income. I will be much more unhappy when the Republicans start dismantling Medicare and Social Security next year.

The current 2018 numbers come from "IRS Announces 2018 Tax Brackets, Standard Deduction Amounts, And More," Kelly Phillips Erb, Forbes, October 19, 2017. The GOP Tax Bill numbers are from "What's in the Final Republican Tax Bill," Wilson Andrews and Alicia Parlapiano, New York Times, December 17, 2017, p. 21 and "What’s in the Tax Bill, and How It Will Affect You," Ron Lieber and Tara Siegel Bernard, New York Times, updated December 17, 2017.

Selfishly, my typical example is a married couple filing a joint return with no dependents.

| Comparison of Federal Income Tax Details | |||

|---|---|---|---|

| Married Filing Joint | Current 2018 | GOP 2018 | Change |

| Standard Deduction | $13,000 | $24,000 | +85% |

| Deduction >65 years | $1,300 | $1,300 | No change |

| Personal Exemption | $8,300 | $0 | Eliminated |

| Total | $22,600 | $25,300 | +12% |

| Number of brackets | 7 | 7 | No change |

| Married filing jointly | 10% for $0-$19,050 15% for $19,051-$77,400 25% for $77,401-$156,150 28% for $156,151-$237,950 33% for $237,951-$424,950 35% for $424,950-$480,050 39.6% for $480,051 + | 10% for $0-$19,050 12% for $19,051-$77,400 22% for $77,401-$165,000 24% for $165,001-$315,000 32% for $315,001-$400,000 35% for $400,001-$600,000 37% for $600,001 + | Rates: -0% to -4% Upper limits: -6% to +32% |

Again, selfishly, I am not overwhelmed by my temporary 12% total deduction/exemption increase or my 3% tax rate cut, both set to expire after seven years because the Republicans don't have 60 votes. Someone making $624,000 would have an overall tax cut of 11% from the rate reductions and bracket changes, almost four times mine. And then the corporate tax cut is 14% and permanent. This doesn't even look at the new loopholes for pass-through income. I will be much more unhappy when the Republicans start dismantling Medicare and Social Security next year.

Friday, December 15, 2017

A Great Recession Glossary and Condensed Explanation

Subprime Mortgages, Side Bets, and the Great Recession

The causes of the Great Recession were subprime adjustable-rate mortgages, and speculation using financial instruments that leveraged the actual market a thousandfold. In other words, greed and fraud. The linked Glossary below allows you to read and understand this bare-boned explanation of the greatest economic collapse since the Great Depression. You can use your browser back arrow to return to the explanation.

- The housing bubble that preceded the crisis was financed with Mortgage-backed Securities (MBSs) and Collateralized Debt Obligations (CDOs) with higher returns than government securities and attractive risk ratings from credit rating agencies. The MBSs and CDOs were created by investment banks with mortgages bought from lenders, and lenders would use MBS and CDO payments to make more loans. [Subprime mortgage crisis, Wikipedia]

- Subprime mortgage lending rose from a national average of 8% to 20% from 2004 to 2006. A high percentage of these subprime mortgages, over 90% in 2006, were adjustable-rate mortgages. [Subprime mortgage crisis, Wikipedia]

- Housing speculation also increased, with the share of mortgages for other than primary residence rising from 20% in 2000 to 35% in 2006-2007. Investors in secondary homes, even those with prime credit ratings, were more likely to default than primary home buyers when prices fell. [Subprime mortgage crisis, Wikipedia]

- In 2005 Dr. Michael Burry of Scion Capital, a one-eyed money manager with Asperger's syndrome, was studying subprime mortgage bonds and felt that the underlying mortgages were worsening in quality. He described this as "the extension of credit by instrument," meaning that an increasing number of home buyers could not afford standard mortgages, so lenders were dreaming up new instuments to justify giving them money. He asked Goldman Sachs and other investment banks to create a credit default swap to let him bet against adjustable rate mortgage-backed CDOs with higher interest rates due in 2007. [The Big Short, Michael Lewis, 2010, pp. 26-31] This type of credit swap eventually became known as the synthetic CDO.

- Mortgage lending standards continued to drop and higher-risk mortgage financial instruments were created. The ratio of household debt to disposable income rose from 77% in 1990 to 127% by the end of 2007. [Subprime mortgage crisis, Wikipedia]

- During this time the underwriting of subprime mortgage CDOs by the rating agencies (Standard & Poor's, Moody's, and Fitch) has been described as "catastrophically misleading." At the same time the supposedly independent agencies received fees from the investment banks. [Subprime mortgage crisis, Wikipedia] S&P did not have loan-level data on the CDOs because the issuing banks refused to provide it. "S&P was worried that if they demanded the data from Wall Street, Wall Street would just go to Moody's for their ratings." [Steve Eisman, The Big Short, pp. 170-171]

- Synthetic CDOs grew in the mortgage-backed securities market because they were cheaper and easier to create than traditional CDOs, which required actual home sales with mortgages to bundle, and could not keep up with demand. Synthetic CDOs jumped from $15 billion in 2005 to $61 billion in 2006, becoming the most common CDO in the US with a value of $5 trillion. [Synthetic CDO, Wikipedia]

- As adjustable-rate mortgages began to increase their interest rates and monthly payments, mortgage delinquencies soared. [Subprime mortgage crisis, Wikipedia]

- Because the credit default swaps in synthetic CDOs were not regulated as insurance contracts, companies selling them were not required to maintain sufficient capital reserves. Demands for settlement of hundreds of billions of dollars of credit default swaps issued by AIG, the largest insurance company in the world, led to its financial collapse. [Shadow banking system, Wikipedia]

- "A bank with a market capitalization of one billion dollars might have one trillion dollars' worth of credit default swaps outstanding. No one knows how many there are! And no one know where they are!" [Steve Eisman, The Big Short, p. 263] By 2012 the total value of synthetic CDOs had dropped from $5 trillion to $2 billion. [Synthetic CDO, Wikipedia]

- The liquidity crisis led to the IndyMac and Lehman Brothers bankruptcies, the Federal takeover of lenders Freddie Mac and Fannie Mae and insurer AIG, the sale of Bear Stearns to JP Morgan Chase and Merrill Lynch to Bank of America, and the loan of billions of dollars to Citigroup, Bank of America, JP Morgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, and others. [Financial crisis of 2007–2008, Wikipedia] and [Troubled Asset Relief Program, Wikipedia]

- The US Financial Crisis Inquiry Commission reported its findings in January 2011. It concluded that the crisis was avoidable and was caused by:

- widespread failures in financial regulation, including the Federal Reserve's failure to stem subprime mortgages;

- dramatic breakdowns in corporate governance, including financial firms taking on too much risk;

- excessive borrowing by households and Wall Street;

- government officials ill-prepared for the crisis, lacking a full understanding of the financial system they oversaw; and

- systemic breaches in accountability and ethics at all levels. [Financial crisis of 2007–2008, Wikipedia]

| Great Recession Glossary | |

|---|---|

| Collateralized Debt Obligation (CDO) | A structured, asset-backed security, notoriously mortgage-backed. A CDO pays investors from the cash flow of the assets it owns. The CDO is "sliced" into "tranches" based on quality. If some loans default and the cash flow cannot pay all investors, those in the lowest tranches suffer losses first. Return varies by tranche, with the safest receiving the lowest rates and the riskiest receiving the highest. Typical tranches are AAA, AA, A, and BBB. [Collateralized debt obligation, Wikipedia] |

| Credit Default Swap | An agreement that the seller will pay the buyer in the event of a reference loan default. The seller of the credit default swap insures the buyer against the default. Created by J.P. Morgan in 1994 for hedging against losses, it has now become a huge, opaque, and unregulated market. [Credit default swap, Wikipedia] |

| Derivative | A financial instrument whose value comes from the value of its underlying entities, such as an asset, index, or interest rate, as opposed to a cash instrument whose value is determined directly by the market. Derivatives can be exchange-traded or over-the-counter (OTC). [Financial instrument, Wikipedia] |

| Financial Instrument | A monetary contract between parties. Examples range from simple bonds or stocks to complicated derivatives like futures, options, and swaps. [Financial instrument, Wikipedia] |

| Mortgage-backed Security (MBS) | A security whose value is based on a specified pool of underlying home mortgages. [Mortgage-backed security, Wikipedia] |

| Security | Any financial instrument that allows trading of a financial asset. [Security (finance), Wikipedia] |

| Structured Financial Instrument | A security designed to transfer risk. It may increase liquidity or funding for a market like housing, transfer risk to the buyer, permit a financial institution to remove certain assets from its balance sheets, or provide access to more diversified assets. [Structured finance, Wikipedia] |

| Synthetic CDO | A CDO using credit default swaps and other derivatives. It is sometimes described as a bet on the performance of mortgages or other products, rather than a real asset-backed security. The value is derived from premiums paying for "insurance" on the possibility that some "reference" securities will default. The insurance-buying "counterparty" may own the "reference" securities and be hedging the risk of their default, or may be a speculator betting they will default. [Synthetic CDO, Wikipedia] |

Thursday, December 14, 2017

Taxes Haven't Gone Away

The latest details on "tax reform" say my medical and state income and property tax deductions are low enough to keep, but I don't think that will raise me to the top 1%, who now get an even lower tax rate. Will there be a new analysis before the vote next week, to show that the bill won't increase taxes for the middle class in order to cut taxes for wealthy political donors? Don't hold your breath.

The changes included a slightly higher corporate tax rate of 21 percent, rather than the 20 percent in the legislation that passed both chambers, and a lower top individual tax rate of 37 percent for the wealthiest Americans, who currently pay 39.6 percent.Any individual tax cuts are still temporary, and the corporate tax cut is still permanent. In the meantime, the kindest thing I can say about President Trump is that he's delusional:

The bill also allows individuals to somewhat choose how to use their state and local tax deduction, giving them the ability to write off up to $10,000 in . . . a combination of property and sales or property and income taxes.

“As a candidate, I promised we would pass a massive tax cut for the everyday working American families who are the backbone and the heartbeat of our country,” Mr. Trump said. “Now we are just days away from keeping that promise. We want to give you, the American people, a giant tax cut for Christmas.”

— "Republican Tax Bill in Final Sprint Across Finish Line," JIM TANKERSLEY, THOMAS KAPLAN and ALAN RAPPEPORT, New York Times, DEC. 13, 2017

Wednesday, December 13, 2017

Treasury's Tax Analysis

"Not only will this tax plan pay for itself, but it will pay down debt."

— "Treasury Secretary Steven Mnuchin: GOP Tax Plan Would More Than Offset Its Cost," Kate Davidson, Wall Street Journal, Sept. 28, 2017

Democratic Sen. Elizabeth Warren is demanding answers from Treasury about why Secretary Steven Mnuchin has yet to release an economic analysis of the GOP's tax overhaul plan, despite repeated promises that he would.

— "Treasury's tax analysis still missing ahead of key Senate vote," Donna Borak, CNN Money, November 30, 2017

The Treasury Department released a one-page analysis of the nearly 500-page Senate tax bill on Monday that suggested the $1.5 trillion plan would more than pay for itself, assuming the economy grows much faster than any independent analysis of the bill has projected.While Treasury Secretary Steven Mnuchin was publicly claiming that more than 100 people in the office were “working around the clock on running scenarios for us” on the economic impact of the tax cuts, career tax experts inside the office said that they had been largely shut out of the process and that such an analysis didn’t exist.

“The report does not appear to be a projection of the economic effects of a tax bill,” said Scott Greenberg, a tax analyst at the conservative Tax Foundation. “It appears, on the other hand, to be a thought experiment on how federal revenues would vary under different economic effects of overall government policies. Which is, needless to say, an odd way to analyze a tax bill.”

“I don’t believe in magic,” said David H. Brockway, staff director of the Joint Committee on Taxation during the Reagan administration. “It’s just a political statement.”

— "Treasury Defends Tax Plan Cost With One-Page Analysis," ALAN RAPPEPORT and JIM TANKERSLEY, New York Times, DEC. 11, 2017

— "Mr. Mnuchin’s Magical Math on Taxes," EDITORIAL BOARD, New York Times, DEC. 11, 2017

It took Treasury more than six months to produce a superficial one-page report.

— "Treasury's Shoddy Tax Analysis," Bloomberg Editors, December 13, 2017

Monday, December 11, 2017

America's Team

Sorry, Jerry. The Green Bay Packers, the only community-owned franchise in American professional sports, is America's Team:

"It's unbelievable, to have a crowd at an away game

and have the whole stadium chanting 'Go, Pack, go!'

and blocking out the Browns fans."

— Brett Hundley, Packers quarterback

New York Times, December 11, 2017

Rather than being the property of an individual, partnership, or corporation, shares are held by over 360,000 stockholders. No one is allowed to hold more than 200,000 shares, or approximately 4% of the over 5 million outstanding.

— Wikipedia

— Wikipedia

Sunday, December 10, 2017

John Bogle on Corporations

From "The Modern Corporation and the Public Interest," a speech by John C. Bogle, Founder of the Vanguard Group, to the Public Company Accounting Oversight Board, December 7, 2017. . . The enterprises that will endure are those that generate growing profits for their owners, something they do best only when they take into account the interests of their customers, their employees, their communities, and indeed the interests of our society. Please don’t think of these ideals merely as foolish idealism. They are the ideals that capitalism has depended upon from the very outset. Hear Adam Smith: “He is certainly not a good citizen who does not wish to promote, by every means of his power, the welfare of the whole society of his fellow citizens.”

No one says it better than Theodore Roosevelt. He begins his 1910 speech on “The New Nationalism” by quoting Abraham Lincoln:

I hold that while man exists it is his duty to improve not only his own condition, but to assist in ameliorating mankind. . . Labor is prior to, and independent of, capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration. (Abraham Lincoln, First Annual Message to Congress, December 3, 1861)Roosevelt continues with his own words:

The material progress and prosperity of a nation are desirable chiefly so long as they lead to the moral and material welfare of all good citizens. . . The absence of effective . . . restraint upon unfair money-getting has tended to create a small class of enormously wealthy and economically powerful men, whose chief object is to hold and increase their power. The prime need is to change the conditions which enable these men to accumulate power which is not for the general welfare that they should hold or exercise. . . The right to regulate the use of wealth in the public interest is universally admitted. (Theodore Roosevelt, Dedication of the John Brown Memorial Park in Osawatomie, Kansas, August 31, 1910)

Wrapping Up

If the mission of today’s modern corporation is to serve the public interest, then our giant, ever more powerful institutional investors must educate themselves as to what is real in investing, and what is illusory. We must understand the nature of traditional capitalism; the wisdom of long-term investing and the folly of short-term speculation; the productive power of compound interest to build returns; and the confiscatory power of compound costs to slash those very same returns. In all, the relentless rules of humble arithmetic. We all need to stand back, take a moment for introspection, and finally recognize that these obvious precepts must drive institutional investment management in the years ahead. The arc of investing is bending toward fiduciary duty and the public interest, and its progress is inevitable.Saturday, December 9, 2017

El-a-noy

Then move your family westward,

Good health you will enjoy,

And rise to wealth and honour

In the state of El-a-noy.

— The American Songbag,

Carl Sandburg, 1927

Good health you will enjoy,

And rise to wealth and honour

In the state of El-a-noy.

— The American Songbag,

Carl Sandburg, 1927

In 1819 Patrick Walsh is born in the village of Cooleyhune, rural County Carlow, Ireland. Twelve years later Bridget Brennan is born in the Carlow village of Guellan.

From the 12th-Century Anglo-Norman invasion to the 17th Century defeat of the Irish earls by Queen Elizabeth I, England had struggled to subdue the recalcitrant Irish. By the mid 1600's three-fourths of Irish lands had been given to Protestant loyalists, many of them absentee landlords in England. The Penal Laws of 1695 barred Catholic Irish from worship, teaching, trade, and professions. Limited to tenant farming, the Irish were force to subdivide farms into smaller and smaller parcels.1

By the 1840's almost half the farms in Ireland were less than five acres in size, too small for more than subsistence farming of potatoes. In 1846 the British Corn Laws were abolished, Irish grain lost its favored status in British markets, employment on larger farms declined, and landlords turned tenant farms to pasture. "The average farmer could achieve a higher standard of living only by giving up farming in Ireland.2

Thursday, December 7, 2017

Convincing the Less Than 1%

Cassi Alexandra for The New York Times

"Canvassers from Americans for Prosperity, the conservative group funded by the Koch brothers, discussed the Republican tax bill with residents of the Azalea Park neighborhood in Orlando, Fla., on Saturday.Broken tax code indeed. The Republican tax bill will not let anyone but the richest 1% keep more of what they do or don't earn.

“We believe it’s time to fix our broken tax code and let families keep more of what they earn,” said Barbara D’Ambrosio, a sophomore high school student reading from her script.

“The American people have waited 31 long years to see our broken tax code overhauled,” the leaders of the Koch’s political network insisted in a letter to members of Congress on Monday, urging swift approval of final legislation. They added that the time had come to put “more money in the pockets of American families.” The problem, as Republicans are learning, is that most Americans do not believe that is what the tax plan will do. Steve Schmidt, a Republican strategist, said that amid all the talk about the need to score an important victory for their party, “it bears mentioning that the ‘win’ is something that is extraordinarily unpopular with 75 percent of the American people.”

In counties where Mr. Trump performed exceptionally well — that he won but Mr. Obama carried in 2012, or where he ran 20 percent ahead of what Mitt Romney received in 2012 — only 17 percent said they expect to pay less in taxes, according to a recent NBC News/Wall Street Journal poll. Another 25 percent said they expected their family would actually pay higher taxes.

— Jeremy W. Peter, "Conservative Groups Seeking Support for Tax Cuts Find It a Hard Sell", New York Times, December 7, 2017

Wednesday, December 6, 2017

Original Medicare versus Medicare Advantage

I'm covering retirement health insurance in four parts:

The table below summarizes the differences between these two Medicare plan bundles:

- Original Medicare,

- Medigap, a private Medicare supplement,

- Medicare Advantage, and

- Typical Medicare insurance bundles.

The table below summarizes the differences between these two Medicare plan bundles:

- Medicare Part A (Hospital) and Part B (Medical/Doctor) with a Medigap supplement and a Part D Prescription Drug Plan, and

- Medicare Advantage Part C with drug coverage.

A New and Improved Bankruptcy Plan

Unfortunately, that's the old Trump. The new Trump has the Republican Congress, so nimble it can turn on a dime and worry about the Federal deficit the day after it passes $1.5 trillion in tax cuts for the richest 1%.

"As the tax cut legislation passed by the Senate early Saturday hurtles toward final approval, Republicans are preparing to use the swelling deficits made worse by the package as a rationale to pursue their long-held vision: undoing the entitlements of the New Deal and Great Society, leaving government leaner and the safety net skimpier for millions of Americans.

Tuesday, December 5, 2017

Medicare Advantage

I'm covering retirement health insurance in four parts:

Original Medicare revenue sources are payroll taxes on employers and employees, premiums, general revenue, Social Security benefit taxes, and interest. Medicare Advantage sources are the same, but Medicare pays the plans a total amount per enrollee, rather than individual fees for services.5

Medicare Advantage (Part C)3

- Original Medicare,

- Medigap, a private Medicare supplement,

- Medicare Advantage, and

- Typical Medicare insurance bundles.

Medicare health plans

Medicare calls plans from private companies that provide Original Medicare Part A and Part B benefits "Medicare Health Plans". The most popular type of Health Plan is Medicare Advantage.1Original Medicare revenue sources are payroll taxes on employers and employees, premiums, general revenue, Social Security benefit taxes, and interest. Medicare Advantage sources are the same, but Medicare pays the plans a total amount per enrollee, rather than individual fees for services.5

Medicare Advantage (Part C)3

Enrollment

• You must be enrolled in Medicare Part A and Part B first, then enroll in a Medicare Advantage plan.Monday, December 4, 2017

Wisconsin Medigap and Prescription Drug Plans

I'm covering retirement health insurance in four parts:

I'm covering retirement health insurance in four parts:- Original Medicare,

- Medigap, a private Medicare supplement,

- Medicare Advantage, and

- Typical Medicare insurance bundles.

See the Expanded Medicare Glossary for help with any unfamiliar terms.

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as coinsurance and copayments, deductibles, and travel outside the U.S. Standardized Medigap plans are offered in all states but Massachusetts, Minnesota, and, you guessed it, Wisconsin. Medicare.gov has a familiar comparison table of the standardized plans, but I won't be talking about whether the popular Plan F is really the best. I'll be talking about Wisconsin Medigap1:

Basic Plan

The Wisconsin Basic Medigap Plan Covers- Inpatient hospital care: covers the Part A coinsurance

- Medical costs: covers the Part B coinsurance (generally 20% of the Medicare-approved amount)

- Blood: covers the first 3 pints of blood each year

- Part A hospice coinsurance or copayment

- Part A skilled nursing facility coinsurance

- An additional 175 days per lifetime for inpatient mental health care

- An additional 40 home health care visits

- Wisconsin-mandated benefits, page 20. These benefits are required by Wisconsin insurance law for Medigap policies. They are available even when Medicare does not cover these

expenses. Medicare Advantage plans are NOT required to provide these benefits. - an additional 30 days of skilled nursing care

- an additional 40 home care visits per year

- expenses for dialysis, transplantation, or donor-related services of kidney disease of $30,000 in any calendar year

- insulin pump or other equipment or non-prescription supplies for the treatment of diabetes

- chiropractor services

- hospital and ambulatory surgery charges and anesthetics for dental care

- breast reconstruction incident to a mastectomy

- colorectal cancer examinations and laboratory tests

- expenses for cancer clinical trials

- catastrophic prescription drugs

Sunday, December 3, 2017

Original Medicare

I'm covering retirement health insurance in four parts:

See the Expanded Medicare Glossary for help with any unfamiliar terms.

In Original Medicare, Part A (Hospital) is paid by previous payroll deductions, and Part B (Medical/Doctor) premiums are standardized, but these plans only cover 80% of hospital and doctor costs.

Medicare Parts A and B are sometimes called original, traditional or fee-for-service Medicare to differentiate from Medicare Advantage health maintenance organization (HMO) or preferred provider organization (PPO) plans. Original Medicare is usually bundled with private supplemental (Medigap) and drug insurance plans to increase coverage.

• 40 quarters of employment with Medicare payroll deductions automatically qualifies you for Medicare Part A (Hospital) with no monthly premium.

• Medicare Part B (Medical/Doctor) requires the payment of a monthly premium.

- Original Medicare,

- Medigap, a private Medicare supplement,

- Medicare Advantage, and

- Typical Medicare insurance bundles.

See the Expanded Medicare Glossary for help with any unfamiliar terms.

In Original Medicare, Part A (Hospital) is paid by previous payroll deductions, and Part B (Medical/Doctor) premiums are standardized, but these plans only cover 80% of hospital and doctor costs.

Medicare Parts A and B are sometimes called original, traditional or fee-for-service Medicare to differentiate from Medicare Advantage health maintenance organization (HMO) or preferred provider organization (PPO) plans. Original Medicare is usually bundled with private supplemental (Medigap) and drug insurance plans to increase coverage.

Enrollment1

• The Initial Enrollment Period for Part A and Part B runs from 3 months before to 3 months after the month you turn 65. If you're continuing on employer or union coverage after 65, you should apply for Part A during the initial period, and Part B during a Special Enrollment Period, starting the month after the employment or insurance ends, whichever comes first. Failure to sign up for Part B during these periods has a late enrollment penalty that will increase your Part B premium forever.• 40 quarters of employment with Medicare payroll deductions automatically qualifies you for Medicare Part A (Hospital) with no monthly premium.

• Medicare Part B (Medical/Doctor) requires the payment of a monthly premium.

Saturday, December 2, 2017

An Absolute Horror of a Tax Bill

"Lucky for you... you're here for rock-bottom. You absolute horror of a human being." — As Good as It Gets

"Lucky for you... you're here for rock-bottom. You absolute horror of a human being." — As Good as It GetsCongress has passed its tax bill. It provides tax cuts for the top 1% by permanently cutting only corporate tax rates, and it takes away the insurance mandate required by the Affordable Care Act to boot.

Congress says on one hand that the cuts will not increase the national debt, because the middle class individual tax cuts will expire. It says on the other hand that it provides a middle class tax cut, because those cuts will be made permanent before they expire. And on the third hand, it says the tax cuts will pay for themselves in the meantime, something Kansas and the rest of history has shown will never happen.

These tax cuts are so unpopular that Paul Krugman wrote

. . . why are Republicans even trying to do this? It’s bad policy and bad politics, and the politics will get worse as voters learn more about the facts. Well, last week one G.O.P. congressman, Chris Collins of New York, gave the game away: “My donors are basically saying get it done or don’t ever call me again.”Congress has not become as psychotic as President Trump. It's merely business as usual, trying to scam the system. But if that's all they need, then why aren't the corporate tax cuts also temporarily temporary?

Thursday, November 30, 2017

Minnesota is Open for Business

Forbes has published its "2017 Best States For Business" rankings, and Wisconsin was 33rd. This is after 6 years for Republican Scott Walker and Republican majorities in both the Assembly and State Senate.

The Forbes Best States for Business profile of Wisconsin, Minnesota, Michigan, and Illinois provides some related data. More details of the factors used in the categories can be found at Methodology.

Wisconsin was between Michigan (28) and Illinois (37), but well below Minnesota (13). Wisconsin's category rankings were in the top half for Quality of Life (9), Economic Climate (19), and Regulatory Environment (24). They were in the bottom half for Growth Prospects (32), Business Costs (38), Labor Supply (39).

I keep wondering how Minnesota did so much better than Wisconsin, since we still have the Paul Bunyan axe. As we look at the details, remember that a lower or poorer ranking is a higher number.

The Business Costs ranking is lower than any nearby states. This category considers labor and energy costs and taxes. The Forbes Wisconsin (38) profile showed the cost of doing business as 2.8% above the national average. Minnesota's (37) was 3.2% above average, and Illinois (30) was 1.7% below the national average.

The Labor Supply ranking is lower than any but Michigan. This considers college or high school grade levels, net migration, projected population growth, union workforce, and population between 25 and 34. According to a Forbes source, “Finding highly-educated millennials is top of mind for all of our clients.” Wisconsin's (39) college attainment was 28.4% and net migration (2016) was -4,400. Minnesota (14) was 34.7% and +11,900. More people are going to college in Minnesota, and voting for it with their feet.

The low Labor Supply ranking may be a reason for this Associated Press headline on November 29: "Walker announces national ad campaign to attract workers". Walker is asking for $7 million for the ads and says the need for workers is statewide.

The Forbes Best States for Business profile of Wisconsin, Minnesota, Michigan, and Illinois provides some related data. More details of the factors used in the categories can be found at Methodology.

| Forbes 2017 Best States For Business | ||||||||

|---|---|---|---|---|---|---|---|---|

| Rank | State | Business Costs | Labor Supply | Regulatory Environment | Economic Climate | Growth Prospects | Quality of Life | Population |

| #1 | North Carolina | 2 | 11 | 9 | 18 | 10 | 16 | 10,146,800 |

| #13 | Minnesota | 37 | 14 | 22 | 13 | 22 | 1 | 5,520,000 |

| #28 | Michigan | 35 | 47 | 16 | 11 | 26 | 17 | 9,928,300 |

| #33 | Wisconsin | 38 | 39 | 24 | 19 | 32 | 9 | 5,778,700 |

| #37 | Illinois | 30 | 36 | 40 | 28 | 35 | 15 | 12,801,500 |

| #50 | West Virginia | 15 | 50 | 50 | 48 | 50 | 43 | 1,831,100 |

Wisconsin was between Michigan (28) and Illinois (37), but well below Minnesota (13). Wisconsin's category rankings were in the top half for Quality of Life (9), Economic Climate (19), and Regulatory Environment (24). They were in the bottom half for Growth Prospects (32), Business Costs (38), Labor Supply (39).

I keep wondering how Minnesota did so much better than Wisconsin, since we still have the Paul Bunyan axe. As we look at the details, remember that a lower or poorer ranking is a higher number.

The Business Costs ranking is lower than any nearby states. This category considers labor and energy costs and taxes. The Forbes Wisconsin (38) profile showed the cost of doing business as 2.8% above the national average. Minnesota's (37) was 3.2% above average, and Illinois (30) was 1.7% below the national average.

The Labor Supply ranking is lower than any but Michigan. This considers college or high school grade levels, net migration, projected population growth, union workforce, and population between 25 and 34. According to a Forbes source, “Finding highly-educated millennials is top of mind for all of our clients.” Wisconsin's (39) college attainment was 28.4% and net migration (2016) was -4,400. Minnesota (14) was 34.7% and +11,900. More people are going to college in Minnesota, and voting for it with their feet.

The low Labor Supply ranking may be a reason for this Associated Press headline on November 29: "Walker announces national ad campaign to attract workers". Walker is asking for $7 million for the ads and says the need for workers is statewide.

Subscribe to:

Posts (Atom)

/>

/>